India’s Energy Mix and the Pathways to Sustainable Development

Pravakar Sahoo explores pathways for India to revolutionize its energy mix in order to achieve sustainable development. He examines major challenges and issues faced by the energy sector, particularly related to renewable and clean energy, and suggests reforms to attract investment in more sustainable energy sources.

India is one of the world’s fastest-growing economies, with rising urbanization and an expanding middle class. The country will account for 25% of the rise in global energy use by 2040 and will have record growth in energy demand over the next several decades.[1] India’s energy profile continues to be heavily dominated by fossil fuel–based sources: by 2040, 42% of the new demand will be met by coal, and the country is projected to be among the largest oil consumers. India contributed 2.48 billion tons of carbon dioxide (CO2) in 2019, which amounted to 7% of global CO2 emissions.[2]

The Paris Agreement aimed to tackle this problem by keeping the global temperature below 2 degrees Celsius relative to preindustrial levels. To do so, countries pledged to develop their own national objectives by 2020. India is facing extreme threats from climate change. The majority of its agriculture is dependent on rains during the monsoon season, and the nearly 175 million people living along the country’s 7,500 kilometer coastline are at risk from rising sea levels and extreme weather conditions. To help mitigate these impacts, India has set a target of producing 175 gigawatts (GW) of renewable energy by 2022, with 100 GW coming from solar, 60 GW from wind, 10 GW from biomass energy, and 5 GW from small hydropower. The country already added nearly 86 GW in 2019[3] and plans to increase its target for renewable energy to 450 GW by 2030.

However, as noted above, fossil fuel consumption is also increasing at a rapid rate. Given India’s role in mitigating climate change, it is important to analyze the country’s energy mix, demand and supply projections, and efforts so far to transition to sustainable energy sources. This essay explores pathways for India to revolutionize its energy mix in order to achieve sustainable development. To this end, the essay examines major challenges and issues faced by the energy sector, particularly related to renewable and clean energy, and suggests reforms to attract investment in more sustainable energy sources.

THE CURRENT ENERGY SCENARIO

India’s primary energy demand has increased with the country’s GDP and population. Electricity consumption has grown at a 7.39% compound annual rate,[4] and electricity demand is expected to grow to 1,894.7 Terawatt-hours (TWh) in 2022.[5] Demand comes from all aspects of the economy, from industrial and commercial to agricultural and residential uses. This trend will continue over the coming decades.[6] A key area of demand-side management will be reducing energy intensity.

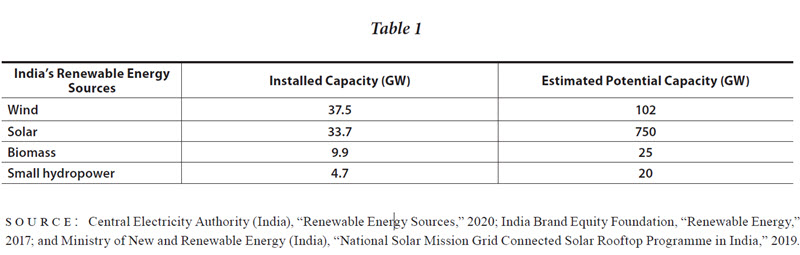

Although India has the supply to meet current energy demand, it lacks quality infrastructure such as conductors, transformers, and other equipment required for transmission and distribution of power. Through several initiatives focused on developing efficient technologies and promoting renewable energy, India is making progress in addressing power supply deficits. Both electricity installation capacity and power generation at an aggregate level from different sources have increased over time. Moreover, the share of clean energy (hydropower, nuclear, and renewable) has increased over the last two decades. India is thus slowly shifting from fuel-based energy sources to non-fuel-based sources to meet peak demand. However, it continues to largely depend on coal and oil for energy, with reliance on hydropower decreasing over the years. Natural gas still has a much smaller presence in India’s energy portfolio than in the global energy mix, while renewable energy rose to 3.6% in 2019 from 0.2% in 2000 (see Table 1 for an overview of India’s renewable energy sources).

Coal. Coal accounts for over 57% of India’s electricity production. Despite large deposits in the east and south, the quality of the country’s coal is not exceptional, with an ash content of 45% and low calorific values. In contrast, high-quality coal imported from Indonesia, South Africa, Russia, and Australia has only ash content of 10%–15%[7]

Oil and gas. India is highly dependent on oil and gas imports, which in 2019 totaled around 229 million tonnes (MT) (roughly 85% of the total oil and gas consumed domestically). The crude oil reserves found in western offshore and Assam fields stand at just over 604 MT, while the natural gas reserves confined to eastern and western offshore fields stood at nearly 1,290 billion cubic meters in 2017. The total installed capacity of oil- and gas-based thermal power stood at 638 megawatts (MW) and 24,937 MW, respectively, in 2019.[8]

Hydropower. In 2019, India had 45.4 GW of hydropower-generating capacity from its twenty-plus hydroelectric dams. According to the Ministry of Power, the country’s hydropower potential is around 145 GW. However, the share of hydropower generation has been declining over time due to energy from other sources increasing at faster rates and a lack of focus from both government and the private sector.

Nuclear. As of 2019, India possessed around 6.8 GW of installed capacity of nuclear energy sources from its 22 nuclear reactors. According to the International Atomic Energy Agency, India produced nearly 35 TWh of electricity through nuclear power in 2017.

Renewable energy. The share of renewable energy in India’s energy mix is expected to increase by 91% from 2017 to 2022, as the share of thermal generation declines due to recent growth in the renewable energy sector. This growth will occur primarily in solar and wind energy.[9]

“Increased prioritization of clean energy projects and promotion of policies that support renewable energy are helping India develop a more efficient clean energy mix.”

CURRENT POLICIES THAT PROMOTE RENEWABLE ENERGY

Increased prioritization of clean energy projects and promotion of policies that support renewable energy are helping India develop a more efficient clean energy mix. Since signing the Paris Agreement, the government has significantly increased the budget allocation and expenditure for the renewable energy sector. Funding has been directed toward grid purchase and distributed renewable power; rural, urban, industrial, and commercial applications; research and development; and other supporting programs. The government has also encouraged faster adoption of electric vehicles by offering upfront incentives to purchase vehicles and include solar storage batteries.[10]

Jawaharlal Nehru National Solar Mission (JNNSM). JNNSM was launched in 2008 to increase the share of solar energy in the total energy mix. It provides a subsidy of up to 40% to individuals and firms that want to buy solar energy systems at lower capital cost. The government is also providing a capital subsidy of 30% to install rooftop solar power in residential, commercial, and industrial buildings. The targets under the mission are 40 GW from grid-connected rooftop solar power projects and 60 GW from large and medium-sized land-based solar power projects. So far, 32.5 GW of solar electric generation capacity has been installed.[11]

Renewable purchase obligation (RPO). An RPO is the mechanism by which distribution companies are obligated to purchase a certain percentage of power from renewable energy sources. It aims at creating more demand for renewable energy, assuring suppliers, and accentuating cross-border nonconventional transactions. RPOs are categorized into solar and non-solar, and every state of India has a specific solar and non-solar share of overall RPOs ranging from 2% to 14%.

Renewable energy certification (REC). REC is a market-based financial instrument to promote renewable energy and ensure compliance with RPOs. RECs address the issue of the gap between renewable energy in states and their RPO requirements. To provide minimum assurance of REC prices, the Central Electricity Regulatory Commission fixed a floor price of $139 per MW for solar and $22 per MW for non-solar and a forbearance price of $200 per MW for solar and $49 per MW for non-solar for the period up to 2017.

Energy Conservation Building Code (ECBC). The ECBC sets minimum energy performance standards. It resulted in an estimated energy savings of 84.34 million kilowatt-hours (kWh) and a reduction in greenhouse gas emissions of 69,154 tons of CO2 per year.[12] ECBC 2017 prescribes energy performance standards for new commercial buildings to be constructed across India to achieve a 50% reduction in energy use by 2030, translating into energy savings of around 300 billion units by 2030 and a peak demand reduction of over 15 GW per year.[13]

Unnat Jyoti by Affordable LEDs for All (UJALA). The UJALA scheme distributed LED bulbs and tube lights to address the high cost of electricity and increased emissions due to inefficient lighting. According to the Ministry of Power, the program had distributed around 300 million LEDs and saved 39,817 million kWh of energy per year as of 2018.

CHALLENGES IN THE RENEWABLE ENERGY SECTOR FOR SUSTAINABLE DEVELOPMENT

Despite the progress India has made in developing the renewable energy sector, the country still faces barriers. Offtaker risk, lack of infrastructure, lack of financial intermediaries, and limited understanding from investors are the four main challenges to overcome.

Offtaker risk. This refers to the risk that the buyer may not fulfill the contractual obligations or will delay or make incomplete payments. Offtakers are primarily state-owned public-sector distribution companies. Given the poor financial health of India’s distribution companies, there is a risk of lagged or incomplete payments. In 2015 the total outstanding debt of distribution companies was approximately $64 billion.[14] Offtaker risk increases the overall risk of the renewable energy projects. To address this issue, the government has implemented Ujwal DISCOM Assurance Yojana, which aims at reducing operational inefficiencies and improving the financial performance of distribution companies. The program mandates to take over 75% of distribution company debt and turn it into state-guaranteed bonds.

Lack of infrastructure. Inefficiencies from the lack of infrastructure to generate and distribute electricity are a key barrier to foreign investment. Moreover, the time taken to obtain permits for building and operating the transmission evacuation infrastructure is very long. These delays increase project construction time, which postpones the commissioning of new projects and ultimately revenues and profits.

Lack of financial intermediaries. Another barrier for Indian institutional investors is a shortage of financial intermediaries in the renewable energy sector. These actors are needed to provide proper information about investment opportunities.

Limited understanding. Renewables lie outside traditional investments, and potential investors are often wary because of their limited understanding of the sector. Domestic institutional investors typically invest in less risky securities and prefer more liquid assets with good credit ratings, which are not available in renewable energy projects.

PATHWAYS FORWARD

According to a report by the Climate Policy Initiative, total investment needed for India to meet its renewable energy targets by 2022 is $189.15 billion, 27% of which is required to be invested in wind, 37% for utility-scale solar projects, 32% for solar rooftop projects, and 4% for biomass and small hydropower projects.[15] Several pathways are available for India to overcome the four challenges outlined above and meet these investment needs. These include foreign direct investment (FDI), domestic investment, and financial incentives.

FDI. According to data from the Department for Promotion of Industry and Internal Trade, cumulative FDI inflows in the power sector from 2000 to 2020 were around $15 billion, which is around 3% of total FDI inflows.[16] The government allowed 100% of FDI under the automatic route to the power sector in 2012, easing the approval process.[17] This included investment in the generation and transmission of electricity through hydroelectric dams, fossil fuel–based thermal power plants, renewable energy generation and distribution, distribution of electricity to households, industrial commercial users, and power trading. There has been an increase in penetration of nonconventional sources of energy in the Indian market, which have seen rising FDI participation.

Domestic investment. As a result of economic reforms and liberalization policies across sectors implemented since the early 1990s, both the private and public sectors have shown a sharp growth in investments, especially in the power sector. The potential investments that are available for renewable projects amount to $411 billion, double the required investment target.[18] Despite large government investments, India’s energy sector relies on the private sector more than ever as public-sector resources are more directed toward public health and sustaining livelihoods. Therefore, to attract private investment, the government has encouraged the participation of nonfinancial banking companies, launched a new investment fund, initiated the rationalization of tariffs, released subsidies, and improved the bankability of power purchase agreements.

Financial incentives. Alternative debt vehicles such as “green” asset-backed securities could be potential financial instruments for encouraging investment in sustainable energy infrastructure. By pooling renewable energy assets from different companies and geographies at various points in their operational lifecycles, banks and other financial institutions can hedge the risks associated with individual renewable energy projects. Green investment banks are government-funded entities that “crowd in” private investment in low-carbon assets, provide debt for projects with existing capital reserves, and raise funds through the issuance of bonds and creation of asset-backed securities. Governments can issue green bonds through private or public banks, the World Bank, or regional development banks to attract both domestic and international investors, which expands the investor base and incentivizes private players interested in cleaner energy. Indian green bonds are very much in demand overseas. With many countries aiming for a green recovery from the recession caused by the Covid-19 pandemic, central banks may induce liquidity in the markets, including through issuing green bonds.

“The government needs to promote investment in cleaner energy sources and make appropriate institutional changes for transitioning India’s energy mix toward renewables.”

POLICY OPTIONS

To revolutionize the country’s energy mix and reduce carbon emissions, India needs to build its renewable energy capacity and increase energy efficiency. In the first eight months of 2019, growth in India’s CO2 emissions slowed down sharply, putting the country on track to record its lowest annual increase in nearly twenty years.[19] The main reason was a slowdown in the expansion of coal-fired electricity generation, along with slowing demand growth and increasing renewable output. Data from the Central Electricity Authority suggests that wind generation rose by 17% in the first six months of 2019 compared to the same period in 2018, with solar up 30% and hydro increasing by 22%.[20] Another reason is that the coal plant load factor in India has come down from 80% to 60% in the last decade. Slowing demand for coal-fired power generation has stalled new coal plant construction plans in Gujarat and Chhattisgarh. NTPC has stated that it will not undertake new coal-power projects and announced investment in a major solar park.[21]

India has shown great progress in the development of renewable energy, especially after the Paris Agreement. Yet major barriers facing this sector remain, such as lack of infrastructure, limited understanding of this sector, offtaker risk in investment, and lack of financial intermediaries. Moving forward, key policy options for transitioning India’s energy mix toward more renewable energy include the following:

- Demand side reforms such as reducing goods and services taxes on electric vehicles and promoting solar photovoltaic technology will encourage consumers to opt for green technology.

- Effective implementation of RECs and RPOs (which complement each other) could be a major factor in driving renewable energy. Incentivizing power generated from renewable energy sources through subsidies or rate cuts, while simultaneously disincentivizing fossil fuels, will also be important.

- Tapping financial resources through financial intermediaries and instruments for the renewable energy sector is also important. Following the Covid-19 pandemic, green bonds may be attractive to investors as countries prioritize a green recovery from the recession.

- Reducing energy intensity will be important for managing demand. India can look to China for successful areas for improvement. China has reduced energy intensity and CO2 emissions by renovating old coal-burning facilities and incorporating ultra-low emissions technology into 80% of its coal-fired energy capacity as of 2019.[22]

In conclusion, although India has made notable commitments to increasing renewable and clean energy investments, progress in the clean energy sector remains inadequate as offtaker risk, lack of infrastructure, lack of financial intermediaries, and limited understanding from investors have inhibited private investment in the sector. As such, the government needs to promote investment in cleaner energy sources and make appropriate institutional changes for transitioning India’s energy mix toward renewables.

Pravakar Sahoo is a professor in the Institute of Economic Growth at the University of Delhi and a senior advisor with NBR’s Asia EDGE project.

Endnotes

[1] United Nations, “World Population Prospects: The 2015 Revision, Key Findings and Advance Tables,” Working Paper, 2015, https://population.un.org/wpp/Publicahtions/Files/Key_Findings_WPP_2015.pdf.

[2] BP, “Energy Outlook,” 2019, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2019-presentation-slides.pdf.

[3] Aarushi Koundal, “India’s Renewable Energy Capacity Reaches 86 GW in 2019; Wind Takes Biggest Share,” ETEnergyWorld, January 15, 2020, https://energy.economictimes.indiatimes.com/news/renewable/indias-renewable-energy-capacity-reaches-86-gw-in-2019-wind-takes-biggest-share/73266746.

[4] Ministry of Statistics and Programme Implementation (India), “Energy Statistics,” 2018.

[5] India Brand Equity Foundation, “Renewable Energy,” 2017.

[6] Note that installed capacity is not equivalent to power supply. However, the two are strongly correlated, as rise in capacity implies commensurate rise in supply.

[7] Shadman Hussain Qaisar and Md Aquil Ahmad, “Production, Consumption and Future Challenges of Coal in India,” International Journal of Current Engineering and Technology 4, no. 5 (2014): 3437–40.

[8] Central Electricity Authority (India), “Renewable Energy Sources,” 2020, http://cea.nic.in.

[9] N. Upreti et al., “Challenges of India’s Power Transmission System,” Utilities Policy 55 (2018): 129–41.

[10] Two initiatives of Ujjwala Yojana and Saubhagya Yojana aim to transform domestic energy by ensuring household access to clean cooking gas.

[11] Government of India, Economic Survey 2019–20 (New Delhi, 2020), chap. 6, https://www.indiabudget.gov.in/budget2020-21/economicsurvey/doc/vol2chapter/echap06_vol2.pdf.

[12] Energy Conservation Building Code 2017 (New Delhi: Bureau of Energy Efficiency, 2017), https://beeindia.gov.in/sites/default/files/BEE_ECBC%202017.pdf.

[13] Government of India, Economic Survey 2019–20.

[14] Power Finance Corporation, http://www.pfcindia.com.

[15] Vivek Sen, Kuldeep Sharma, and Gireesh Shrimali, “Reaching India’s Renewable Energy Targets: The Role of Institutional Investors,” Climate Policy Initiative, December 2016, https://www.climatepolicyinitiative.org/publication/reaching-indias-renewable-energy-targets-role-institutional-investors.

[16] Department for Promotion of Industry and Internal Trade (India), “Quarterly Fact Sheet on Foreign Direct Investment,” September 2020, https://dipp.gov.in/sites/default/files/FDI_Fact_sheet_September_20.pdf.

[17] The automatic route is one where government approval is not needed for investment in that sector. The foreign investors need only inform the Reserve Bank of India about the amount of investment.

[18] Sen, Sharma, and Shrimali, “Reaching India’s Renewable Energy Targets.”

[19] Lauri Myllyvirta and Sunil Dahiya, “Analysis: India’s CO2 Emissions Growth Poised to Slow Sharply in 2019,” Carbon Brief, October 24, 2019, https://www.carbonbrief.org/analysis-indias-co2-emissions-growth-poised-to-slow-sharply-in-2019.

[20] Central Electricity Authority, “Renewable Energy Sources.”

[21] Sarita Singh, “NTPC to Invest Rs 25k Crore to Set Up Solar Park,” Economic Times, September 19, 2019, https://economictimes.indiatimes.com/industry/energy/power/ntpc-to-invest-rs-25k-crore-to-set-up-solar-park/articleshow/71193687.cms?from=mdr.

[22] “How Is China’s Energy Footprint Changing?” Center for Strategic and International Studies, ChinaPower, February 15, 2016, updated January 30, 2021, https://chinapower.csis.org/energy-footprint.