Commentary from Clean EDGE Asia

Thailand’s Path toward Carbon Neutrality and the Implications for the Mekong Subregion

Twarath Sutabutr outlines Thailand’s plan for carbon neutrality and the role of cross-border energy trade in Thailand’s energy mix. He considers the implications of future cooperation in the Mekong subregion and policy challenges for achieving carbon neutrality.

Thailand will require balanced and coordinated efforts from all sectors through national-level interventions to achieve its carbon-neutrality target. The country has already achieved partial decoupling of economic growth and emissions over the last few years, mainly through energy intensity improvements in the industrial sector. Untapped potential still exists in other sectors, including power generation. Along with these efforts to reduce the energy intensity of its GDP, Thailand has also focused on reducing the emission intensity of its electricity generation sector through increased penetration of renewable energy in the total fuel mix.

However, unlike conventional electricity generation, renewable energy–based generation is intermittent and variable. Additionally, the demand for electricity installed capacity in Thailand is projected to nearly double between 2018 and 2037 from 41,800 megawatts (MW) to 77,211 MW. Therefore, even in the face of the growing importance of domestically developed renewable energy projects, electricity trading will play an essential role in the near future, both to balance the variable renewable power supply and to meet absolute demand. Locally produced energy from variable renewable energy sources such as solar and wind will not be sufficient to support this growing demand, even without considering the intermittency and volatility problems. In such circumstances, electricity purchases from countries in the Mekong subregion—for instance, from Laos—are seen as one of many possible solutions for stabilizing and greening Thailand’s fuel mix in the short to medium term.

This essay summarizes Thailand’s vision and plan for carbon neutrality and outlines its position and action on electricity trade within the Mekong subregion. It then discusses the implications of future cooperation in the Mekong subregion and finally considers pathways forward to enhance regional connectivity and cooperation on achieving net-zero goals.

Thailand’s Vision and Plan toward Carbon Neutrality

On October 30, 2021, Prime Minister Prayuth Chan-o-cha announced Thailand’s strategic plan and targets for its pathway to carbon neutrality at the 26th UN Climate Change Conference leaders’ summit in Glasgow.[1] Per the plan, Thailand aims to achieve peak greenhouse gas emissions by 2030, carbon neutrality by 2050, and net-zero greenhouse gas emissions by 2065. It will also welcome international cooperation on finance, technology transfers, and capacity building to accelerate progress toward these goals.

In order to achieve carbon neutrality by 2050, Thailand has formulated a new National Energy Plan, which is a policy framework to guide its agencies in the transformational change to clean energy systems.[2] The 2050 carbon neutrality scenario highlights that the share of renewable electricity generation will be at least 50% of new power generation capacity. To achieve its immediate 2030 goals, Thailand plans to increase wind power from 270 MW to 2,500 MW, increase imported hydro power from 1,400 MW to 1,869 MW, increase solar power from 5,149 MW to 7,087 MW, and increase biomass energy from 1,120 MW to 1,197 MW.[3] It also plans to increase the market share of electric and plug-in hybrid vehicles to 69% by 2035, improve energy efficiency, and decrease net emissions to 41 million metric tons of CO2 equivalent by 2050 in the industrial processes and product use, waste, and agriculture sectors.

To achieve its 2065 net-zero target, Thailand has emphasized the importance of innovation and R&D, especially in low-carbon electricity generation; carbon capture, utilization, and storage (CCUS); bioenergy with CCUS; and the hydrogen economy.[4] Decarbonizing public transportation infrastructure and networks will be prioritized, including a complete transformation of the vehicle fleet, the development of public fast-charging networks for electric vehicles, and the installation of hydrogen fueling stations. The following guidelines are part of the Ministry of Energy’s 2021 energy policy framework:

- Increase the share of new renewable electricity generation to 50%, increase the share of electric vehicles to 30% by 2030, increase energy efficiency by reducing energy intensity by 36% by 2037 and 40% by 2050, and promote energy system transformation through decarbonization, digitalization, decentralization, deregulation, and electrification.

- Utilize alternative technologies and systems to support low-carbon power generation, such as CCUS, energy storage systems, microgrids, and peer-to-peer and net-metering markets.

- Better utilize natural gas for energy system transformation by ensuring good governance of natural gas systems and markets and investing in liquefied natural gas infrastructure.

- Transform oil use by implementing higher standards for crude oil distillation, removing petroleum subsidies, and reconsidering more targeted subsidy schemes for liquefied petroleum gas in households.

- Support energy independence and reduce the impact of changing energy prices by expanding R&D in renewable energy technology and alternative fuels (e.g., hydrogen), increasing domestic renewable energy production, and digitalizing the renewable energy control center platform for both on-grid and off-grid areas.

- Improve energy efficiency through digital technology and innovation, specifically through new building codes, efficient targets and standards, and data-sharing platforms.

These are ambitious goals for a developing country with limited access to modern energy infrastructure. The upcoming 2024 National Energy Plan will be a good starting point for Thailand because it contains concrete measures to reduce carbon emissions in the near future. To reach the midcentury goals, cross-border electricity trade will play an important role.

Cross-Border Energy Trade and Its Role in Thailand’s Energy Mix

Thailand has long been a net importer of energy. Even though the Gulf of Thailand holds a substantial deposit of petroleum resources and there are coal and lignite mines in the north, they are not sufficient to ensure national energy security. Starting with the 2006 Power Development Plan, guidelines were created for cross-border electricity trade: imported electricity should not exceed 25% of the total installed capacity, and imports from a single country should not exceed 13% of the total installed capacity. In 2020, Thailand’s energy dependency index decreased to 54%, with 46% of its consumed energy being supplied by imports.[5] A large amount of these imports come from its neighbors, such as piped natural gas from Myanmar and purchased electricity from Laos. To achieve energy independence, Thailand has granted its state-owned enterprises, such as the Electricity Generating Authority of Thailand (EGAT) and PTT Public Company Limited, more active roles in the upstream projects importing energy from the two countries.

Thailand has traded electricity with its neighbors for decades, starting in 1971 when it imported electricity from the Nam Ngum 1 project in Laos. For economic reasons, purchasing electricity from Laos has been a great alternative for securing the country’s long-term supply. Negotiations between Thai authorities (the Energy Policy and Planning Office and EGAT) and their Laotian counterparts follow the principle of “avoided cost.”[6] If a project being developed in Laos offers a purchase tariff below the avoided cost, then it will be nominated (by the Laotian authorities) and tabled for consideration (by the Thai authorities). Purchasing carbon credits alongside electricity has never been part of the agreement.

There are two types of contracts between the countries: grid-to-grid power exchange and project-to-grid power purchase agreements (PPAs). In the former type of contract, the net exchange of electricity is settled on an annual basis, where the agreed price is based on Thailand’s flexible tariff formula. However, there are only two Laotian electricity sources, namely the Nong Khai–Vientiane power line, fed by the Nam Ngum 1 Dam in the north, and the Ubon Ratchathani–Pakse power line, fed by three hydropower projects in the south. All assets, as well as the dispatch and load-balancing mechanisms, are owned and operated by state-owned Électricité du Laos (EDL). Due to the country’s underdeveloped grid infrastructure, it is mutually agreed that Laos may elect to buy back electricity from the substations in Thailand. The buy-back tariff is based on the generation cost plus EGAT’s wheeling charge. With this agreement, there was a time when EDL simply overused its electricity and bought it back from EGAT (2001–15), going into debt. The situation was resolved when EDL constructed more hydropower projects (with financial assistance from China as well as other international organizations) and became a net exporter to Thailand. Of note is that this type of contract is seen as friendly and perpetual.

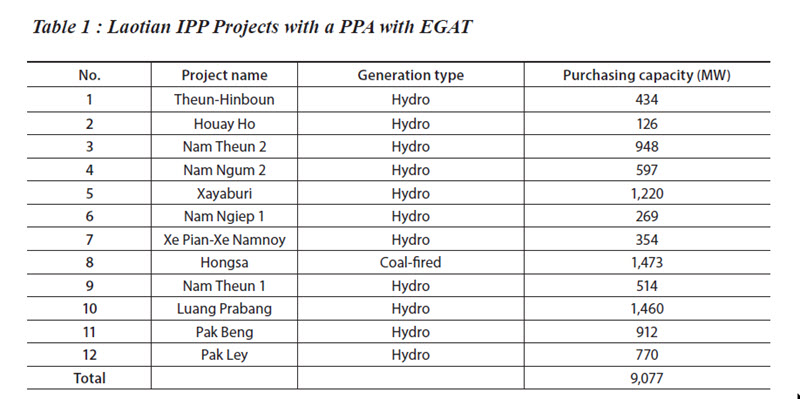

The second type of contract is a project-to-grid PPA, which is strictly for independent power producer (IPP) projects built and operated by consortiums of international companies. Most are electricity sales to Thailand (i.e., to EGAT), but a small number are to Laos (i.e., to EDL). The projects design and build the generating facilities (either hydropower or coal-fired) and high-voltage transmission lines needed to trade electricity between the two countries. Dispatch and load-balancing duties are within the purview of EGAT and are therefore integral to the Thai national grid. They just happen to be in Laos. At present, there are twelves projects (totaling 9,907 MW) using this type of contract. There are two levels of this commercial arrangement: national and company.

At the national level, both countries enter into a PPA memorandum of understanding, which specifies three key elements of collaboration: (1) the total amount of electricity to be sold from Laos to Thailand (the latest agreement is 10,500 MW, according to a National Energy Policy Council resolution on November 5, 2021), (2) the types of generators used in a project, which are at present exclusively hydro and thermal, and (3) the assigned parties to execute the project or collaborate moving forward, where both governments will, from time to time, nominate the involved parties.

The third element leads into the company-level proceedings. Whereas Thailand always assigns EGAT, Laos has selectively nominated different organizations or companies to negotiate, though a state-owned enterprise like EDL is always involved. Regardless, EGAT will negotiate and enter into the commercial agreement with the assigned IPP from the Laotian side (Table 1).

Mekong Subregion Cooperation to Achieve Net Zero

Thailand’s target is both ambitious and challenging. The major challenge of its carbon neutrality vision is how to achieve a 50% renewable energy supply by 2030. It is widely believed that domestic supply alone will be insufficient. Instead, Thailand must continue to engage with Mekong subregion countries to import more renewable energy. Given this reality, what can Thailand and its counterparts in the Mekong subregion do differently in order to secure carbon neutrality through cross-border electricity trading?

Deeper cooperation on environmental concerns, especially climate change, is expected to create green and low-carbon development for the Mekong subregion and its countries, resulting in economic growth, energy security, and reduced environmental impacts. One study reported that unrestricted energy resource development and trade within the Mekong subregion would provide economic and environmental benefits for each of the regional countries, especially through the development of renewable energy resources with the potential to reduce CO2 emissions.[7] Given that Thailand still relies on imported renewable energy, it must cooperate with Laos to move beyond hydropower projects. However, there is room for further improvement to achieve a greater impact on the regional scale by considering the following four steps:

- 1. Phasing out coal projects and banning new projects developed exclusively for export purposes.

-

2. Removing the 10,500 MW cap of electricity sold from Laos to Thailand.

-

3. Allowing PPAs to follow market mechanisms, such as bidding or auctioning.

-

4. Activating cross-border trading for solar, wind, and other types of renewable energy technologies to diversify away from hydropower projects.

The use of renewable resources in Laos to generate electricity to sell to Thailand can be conceptualized as a regional energy hub. Purchasing power from Laos not only enhances Thailand’s energy security but also contributes to the reduction of greenhouse gas emissions in the energy and power sectors in the region. Further, supportive mechanisms can be used, such as renewable energy certificates. There are also other advantages for Laos, such as generating income, reducing poverty, improving quality of life, and achieving its own energy security.

Policy Challenges for Achieving Carbon Neutrality

Electricity reform in Thailand. Reform of the electricity sector in Thailand has started and stopped many times over the years, but there should be a persistent push to do so. The private sector could be allowed to participate in a greater scope of power generation, transmission, and distribution activities, and renewable energy development could be liberalized. The levels of private participation and renewable energy utilization can be increased to improve energy security, maintain economic growth, and minimize greenhouse gas emissions. The key challenge to deeper reform in the electricity sector is inducing the private sector to invest in renewable energy development. Many financial and nonfinancial incentives are being offered to the private sector, but progressive and gradual liberalization of the sector is needed to allow more advanced technologies, such as the smart grid, to emerge. Thus, it is important to develop suitable “sandboxing” policies to make investment in smart grids attractive to the private sector.

Regional cooperation in the Association of Southeast Asian Nations (ASEAN). Cooperation among member countries is expected to increase in the years to come through the ASEAN Economic Community (AEC). The AEC primarily focuses on the economic integration of member countries by eliminating both tariff and non-tariff barriers, addressing the movement of professionals and capital, and facilitating customs clearance procedures. However, environmental concerns are not yet part of AEC cooperation. Thus, the challenge for regional cooperation on carbon neutrality is to bring environmental considerations into the AEC system.

Conclusion

Thailand has recognized climate change as an existential threat to the planet and has formulated several national plans and policies to reduce emissions and eventually achieve carbon neutrality by 2050. Both the public and private sectors have been actively involved in reducing greenhouse gas emissions, and a series of measures have been implemented in each sector. The primary ways to reduce emissions in Thailand and the Mekong subregion are to develop a carbon-neutral vision with domestic renewable energy development and promote more cross-border electricity trading. Even though Thailand has made significant progress toward energy trading in the Mekong subregion, more needs to be done.

In the short term, Thailand needs to improve the implementation of its current policies on power purchases from Laos. Additionally, the four policy options above will ensure cleaner and greener electricity trading in cross-border transactions through market mechanisms. Future policies should encourage private-sector participation, which would facilitate environmental advancements through investments and technology transfer.

At the same time, new alternatives, such as regional trading schemes and the transmission of power via a transit country, need to be studied. Policy initiatives concerning greenhouse gas emissions reduction, such as constructing more solar and wind projects, could be further promoted as well. Moreover, suitable concepts and models should be developed to fit the Mekong subregion context. Awareness could be increased by integrating new ideas and policies into educational systems in order to facilitate environmentally friendly behavior.

There is no silver bullet for Thailand to achieve its target for net-zero greenhouse gas emissions. It is important for each country to proactively chart its own unique energy transition through clear and supportive mechanisms and measures.

Twarath Sutabutr is the President of the Office of Knowledge Management and Development, which is a public organization under Thailand’s Prime Minister’s Office. Dr. Twarath has experience working on a wide range of public policy coordination and initiatives, such as renewable energy, scenario planning, and international cooperation on sustainable development. He was a 2021–22 Clean EDGE Asia Fellow at the National Bureau of Asian Research.

Endnotes

[1] Suwit Rattiwan, “Thai PM to Announce Thailand’s Climate Change Reduction Plans at COP26,” National News Bureau of Thailand, November 1, 2021, available at https://aseannow.com/topic/1237610-thai-pm-to-announce-thailand%E2%80%99s-climate-change-reduction-plans-at-cop26.

[2] Energy Policy and Planning Office (Thailand), National Energy Plan (Bangkok, August 2021), https://www.eppo.go.th/index.php/en/component/k2/item/17093-nep.

[3] Peter du Pont, “Ambitious Steps to Go Carbon Neutral,” Bangkok Post, November 25, 2021, https://www.bangkokpost.com/opinion/opinion/2221143/ambitious-steps-to-go-carbon-neutral.

[4] Radhanon Diewvilai and Kulyos Audomvongseree, “Possible Pathways toward Carbon Neutrality in Thailand’s Electricity Sector by 2050 through the Introduction of H2 Blending in Natural Gas and Solar PV with BESS,” Energies 15, no. 3979 (2022).

[5] Department of Alternative Energy Development and Efficiency (Thailand), Energy Balance of Thailand 2020 (Bangkok, 2020), https://webkc.dede.go.th/testmax/node/5736.

[6] “Fundamentals of Thai Electricity Business and Power Tariff,” Petroleum Institute of Thailand, March 2022, www.ptit.org/master/event/generate_pdf?id=62.

[7] Asian Development Bank, Renewable Energy Developments and Potential in the Greater Mekong Subregion (Manila: ADB, 2015), https://www.adb.org/sites/default/files/publication/161898/renewable-energy-developments-gms.pdf.