President Jokowi's Economic and Energy Reforms: A Year in Review

President Jokowi's Economic and Energy Reforms: A Year in Review

Indonesian president Joko “Jokowi” Widodo will visit the United States on October 25-28, 2015, just over a year after he was sworn in as president. In the lead-up to his visit, the National Bureau of Asian Research prepared a quick recap of President Jokowi’s major economic and energy reforms during his first year in office that will give context to his agenda while in the United States.

Indonesian president Joko “Jokowi” Widodo will visit the United States on October 25-28, 2015, just over a year after he was sworn in as president. Since entering office, President Jokowi has implemented several reforms to the economy and energy sector in an effort to spur growth in the world’s fourth most populous nation. However, Indonesia’s GDP growth rate slumped to 4.7% in the second quarter of 2015, the country’s slowest rate in six years, and President Jokowi’s approval ratings have dropped to around 50%, down from 70% when he was first elected.

U.S. Secretary of State John Kerry and President Widodo

As he arrives in the United States, President Jokowi will continue to pursue his economic policy goals by meeting with tech giants and mining companies, discussing the Trans-Pacific Partnership and other economic matters with President Obama, and promoting Indonesia as an open place for business. In the lead-up to his visit, the National Bureau of Asian Research has prepared a quick recap of President Jokowi’s major economic and energy reforms during his first year in office that will give context to his agenda while in the United States.

October 20, 2014

ELECTED PRESIDENT

Joko Widodo (Jokowi), former governor of Jakarta, is elected president of the Republic of Indonesia.

November 18, 2014

JOKOWI ACTS ON GAS PRICES

As promised, President Jokowi increases subsidized gasoline prices by 31% from 6,500 rupiahs ($0.48) per liter to 8,500 rupiahs ($0.62) per liter. Diesel increases from 5,500 rupiahs ($0.40) per liter to 7,500 rupiahs ($0.55), while prices for kerosene remain at 2,500 rupiahs ($0.18).

November 28, 2014

NEW LEADERSHIP FOR PERTAMINA

To restore confidence in Pertamina, Indonesia’s state-owned oil and gas company, after a series of corruption scandals, the Jokowi administration appoints Dwi Soetjipto as the new head and dismisses the company’s board directors. Soetjipto is tasked with helping the Jokowi administration address corruption, improve transparency, and revamp Southeast Asia’s largest crude producer.

January 1, 2015

FUEL SUBSIDIES OVERHAULED

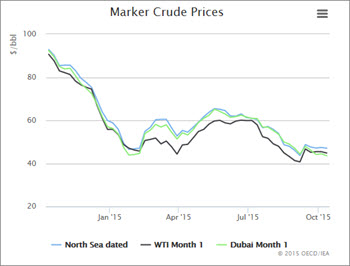

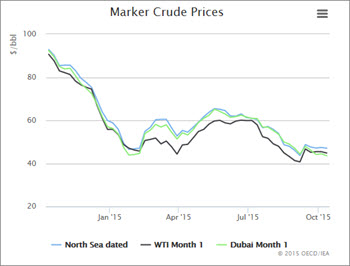

President Jokowi begins major reforms to Indonesia’s decades-long fuel-subsidies program, allowing petrol prices to move each month with the global price of oil. Subsidies for premium gasoline, which made up 65% of Indonesia fuel subsidies, are largely removed, while small subsidies are kept for diesel and kerosene. Premium gas prices, however, drop 10.5% from 8,500 rupiahs ($0.62) per liter to 7,600 rupiahs ($0.56) due to the plunge in global oil prices. These reforms free up $20 billion for Indonesia to allocate toward more productive expenditures.

Marker Crude Prices

Marker Crude Prices

January 16, 2015

LOW GLOBAL OIL PRICES EASE TRANSITION FOR INDONESIAN CONSUMERS

Due to the continued decline in world oil prices, President Jokowi announces another cut to the price of premium fuel, from 7,600 rupiahs ($0.56) to 6,600 rupiahs ($0.48) per liter.

January 26, 2015

BKPM BECOMES ONE-STOP SHOP

The Jokowi administration establishes a one-stop integrated service at Indonesia’s Investment Coordinating Board (BKPM) in an effort to reduce red tape and streamline foreign investment. This move consolidates the authority to issue business permits—originally assigned to different ministries and institutions—into Indonesia’s investment agency.

March 1, 2015

OIL PRICES REBOUND

As global oil prices begin to rebound, the price of premium gasoline increases to 6,900 rupiahs ($0.51) per liter. Prices increase again to 7,900 rupiahs ($0.58) per liter at the end of March, signaling that the initial benefit of low global oil prices to Indonesian consumers may be fading.

March 23, 2015

JOKOWI REACHES OUT

President Jokowi visits Japan and China with the intention of signing business deals worth billions of dollars.

May 31, 2015

RENEWABLE ENERGY GETS A BOOST

To strengthen efforts to advance the sustainable use of energy, the government declares that it will increase the proportion of renewable energy use in Indonesia from 5%–6% to 19% by 2019. Building on this, government officials announce in June that the budget for renewable energy and energy conservation could quintuple to 11 trillion rupiahs ($808.9 million) in 2016.

June 5, 2015BACK TO OPEC

Indonesia gains approval from the Organization of the Petroleum Exporting Countries (OPEC) to rejoin the group after a seven-year hiatus. Once a founding member, Indonesia dropped out of OPEC in 2008 due to high oil prices, rising domestic demand, and declining production. It plans to officially rejoin OPEC during the group’s next policy meeting in December 2015—a move that will add 900,000 barrels of oil per day to OPEC’s total output.

July 22, 2015

NEW OIL AND GAS LAW

Indonesian lawmakers release a draft revision to the 2001 oil and gas law. In 2012, Indonesia’s constitutional court declared that parts of the 2001 law were unconstitutional. The court argued that oil and gas supervision should not fall under an independent agency (BP MIGAS)—as the 2001 law dictates—but should instead fall under state control. The draft suggests that Indonesia will give more authority to its state-owned enterprises in regard to oil and gas production operations. Lawmakers expect to pass the law by the end of 2015 or early next year.

July 23, 2015

A WEAK AND UNSTABLE RUPIAH

The Indonesian rupiah falls to 13,395 rupiahs to the dollar, its weakest level since the Asian financial crisis of 1997–98. The rupiah continues to depreciate to 14,600 rupiahs through early October, before strengthening sharply on October 6th as investors rush to cover bets that the rupiah would weaken even further.

August 10, 2015

SUBMISSION OF NEW NATIONAL ENERGY PLAN

Indonesia’s Ministry of Energy and Mineral Resources presents the final draft of the government’s new National Energy Plan (RUEN) for review at the 15th annual meeting of the National Energy Committee. The RUEN serves as Indonesia’s energy management plan, and once approved, will serve as a blueprint for the next 35 years.

August 12, 2015 CABINET RESHUFFLING

With Indonesia’s growth rate declining to a six-year low and facing growing criticism about the underperformance of several ministers in his cabinet, President Jokowi reshuffles six cabinet ministers, focusing on key economic positions. Notable changes include the appointment of Darmin Nasution, former governor of Bank Indonesia, as coordinating economic minister; Sofyan Djalil, the previous economic minister, as head of the National Development Planning Board; and Harvard-educated Thomas Lembong, a former investment banker, as the new trade minister.

August 13, 2015

FURTHER STREAMLINING OF BUSINESS PERMITTING

In its effort to further improve business licensing, the Jokowi administration gives BKPM permitting authority for over twenty energy and mining permits. The government aims for a complete handover of all oil and gas permits to BKPM by October, two months earlier than originally planned.

September 9, 2015

DEREGULATION

In the first installment of his economic reform package, President Jokowi pledges to remove 89 regulations that obstruct business investment, including processes for obtaining licenses, land, and bank accounts. The government hopes that these reforms will strengthen industry and improve trade across the region.

September 25, 2015

PERTAMINA SUFFERS $1 BILLION BLOW

Pertamina, Indonesia’s state-owned oil and gas company, loses over $1 billion in 2015 as it bears the brunt of energy subsidy cuts. Although President Jokowi cut subsidies early in his administration, the government has forced prices to stay below market value in order to ease the burden on consumers.

September 29, 2015

DEREGULATION PART 2

Indonesia announces the second installment of its economic reform package, continuing its effort to improve the country’s investment climate. Key reforms include improving investment permit procedures, shortening permit processing times, and cutting income taxes for exporters that deposit export proceeds in Indonesian banks.

October 7, 2015

BACKTRACKING ON FUEL SUBSIDY REFORM?

In its third economic reform package, the Jokowi government announces that it will cut energy prices for companies and protect rice farmers by insuring them against crop failures. This set of reforms includes a diesel price cut of nearly 3% in a move to support transportation companies and the mining industry. Moody’s Investors Service fears that the decision to cut energy prices backtracks on President Jokowi’s fuel subsidy reforms. Fuel-related subsidies still constituted 65.7% of Indonesia’s budget as of July.

October 15, 2015

MORE PREDICTABLE MINIMUM WAGE

In his fourth policy package in the span of five weeks, President Jokowi vows to make minimum wage increases more predictable by pegging wage increases to inflation and GDP growth. He also broadens eligibility for micro loans and opens up export credits to small and medium-sized enterprises.

October 22, 2015

OPENING UP INVESTMENT TO RESTRICTED SECTORS

In an interview with the Wall Street Journal just days before his U.S. visit, President Jokowi considers easing restrictions on laws that limit foreign investment in certain sectors of Indonesia’s economy, particularly e-commerce. An aide to his administration also hinted that there is interest in discussing the Trans-Pacific Partnership while in Washington.

This timeline was prepared by Andy Nguyen, Project Associate in NBR’s Trade, Economic, and Energy Affairs group.