Commentary

Indonesia's Strategy toward Critical Minerals and Cooperation with the United States

Han Phoumin analyzes Indonesia’s critical mineral strategy, its bilateral engagement with the United States, and the broader implications for regional and global supply chains. It provides a comprehensive assessment of the opportunities and risks in aligning Indonesia’s mineral wealth with the global decarbonization agenda.

Amid growing national security concerns about supply chain resiliency and the global energy landscape’s shift toward decarbonization, critical minerals, such as nickel, cobalt, rare earth elements (REEs), copper, lithium, and bauxite, have emerged as indispensable inputs for countries and companies around the world. These minerals are necessary for the developing and manufacturing of emerging technologies ranging from semiconductors to quantum computing, as well as clean technologies including electric vehicles (EVs), renewable energy infrastructure, and battery storage systems. Soaring demand for these minerals has placed significant pressure on supply chains that are highly concentrated and geopolitically sensitive.

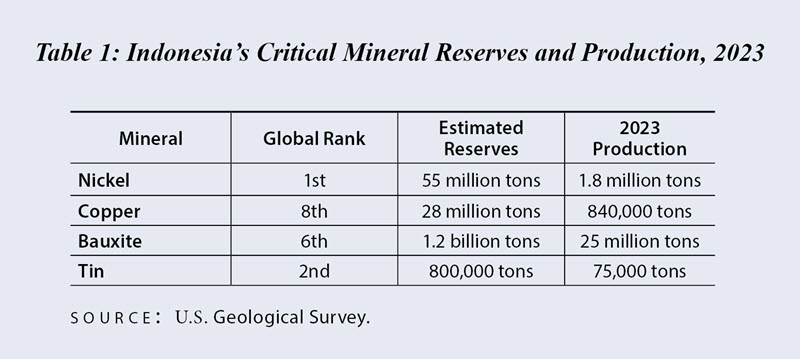

Indonesia, endowed with substantial reserves of critical minerals, is increasingly being recognized as a central link in these vital global supply chains. Ranked as the world’s largest nickel producer and among the top ten producers of copper and bauxite, Indonesia plays a strategic role in the supply of raw materials required to meet global demand. The government’s policy framework emphasizes not only extraction but also downstream processing, aiming to industrialize and increase domestic value capture. Simultaneously, Indonesia is enhancing cooperation with strategic partners, such as the United States, to attract high-quality investment, improve environmental, social, and governance (ESG) standards, and gain access to advanced technologies.

This essay analyzes Indonesia’s critical mineral strategy, its bilateral engagement with the United States, and the broader implications for regional and global supply chains. It provides a comprehensive assessment of the opportunities and risks in aligning Indonesia’s mineral wealth with the global decarbonization agenda.

Indonesia’s Critical Mineral Landscape

Indonesia’s mineral endowment is both vast and diverse. According to the U.S. Geological Survey, Indonesia holds over 21 million metric tons of nickel reserves—about 22% of global reserves—making it the largest globally. The country produced 1.8 million metric tons of nickel in 2023, a significant increase from 771,000 metric tons in 2020. Indonesia also ranks among the top producers of bauxite, primarily in West Kalimantan and Riau Islands.

Copper production is another critical pillar of Indonesia’s mineral wealth. Grasberg, one of the world’s largest copper and gold mines, is located in Papua and operated by PT Freeport Indonesia. Indonesia’s copper output reached 840,000 metric tons in 2023, positioning it as a strategic supplier for energy infrastructure and semiconductor manufacturing.

Southeast Asia more broadly is home to significant untapped potential in REEs and other strategic minerals. According to the Australian Strategic Policy Institute, countries such as Indonesia, Vietnam, and Myanmar possess valuable REE reserves that remain underdeveloped due to technological, regulatory, and ESG barriers.

Indonesia’s Policy Evolution: From Extraction to Industrialization

Indonesia’s approach to critical minerals has evolved significantly in the past decade, with government policies seeking to move the country up the value chain beyond extraction. The 2009 Mining Law introduced a regulatory shift aimed at achieving this by banning the export of unprocessed ores and mandating domestic processing. This was operationalized in 2014 with the nickel ore export ban and was later extended to bauxite and copper. The goal was to stimulate investment in domestic capacity for smelting, refining, and manufacturing.

Between 2014 and 2023, more than 30 nickel smelters were constructed, primarily in Central Sulawesi and North Maluku. The Indonesia Morowali Industrial Park and Weda Bay Industrial Park are two large-scale hubs that now host nickel processing and battery-precursor production. The downstream policy—termed hilirisasi—is credited with increasing Indonesia’s export value of processed minerals, reducing reliance on raw exports, and attracting over $30 billion in foreign direct investment between 2019 and 2023.

The Prabowo administration has reaffirmed Indonesia’s ambition to move beyond mineral processing and capture greater value from the country’s resource endowment through full-scale industrialization. Building on the downstreaming policies initiated under President Jokowi, President Prabowo has emphasized continuity, while adding a focus on accelerating domestic EV battery and vehicle manufacturing. His administration has pledged to streamline permitting processes, expand fiscal incentives, and develop industrial parks dedicated to EV supply chains. These measures are designed to strengthen Indonesia’s role as a regional production hub while ensuring that investments generate skilled jobs and technology transfer within the country.

In parallel, the administration is adopting a more strategic geopolitical posture. Recognizing the intensifying competition between major economies for critical minerals, Prabowo aims to diversify partnerships and avoid overreliance on any single foreign partner. This includes deepening ties with U.S., South Korean, Japanese, and European firms to balance Indonesia’s existing dependence on Chinese investment. By coupling resource nationalism with pragmatic international engagement, the government seeks to secure Indonesia’s position not only as a leading supplier of ESG-compliant minerals but also as a central node in the global EV and clean energy value chains.

Indonesia’s industrial ambitions also extend beyond smelting. The country aims to become a regional hub for EV battery production and EV assembly. Indonesia Battery Corporation, formed as a state holding company in 2021, has signed partnerships with multiple international companies to develop integrated battery value chains.

Furthermore, Indonesia is promoting its role in the semiconductor supply chain. While it does not yet produce semiconductors, it supplies key inputs such as high-purity tin and copper used in chip interconnects. Integrating mineral and semiconductor strategies could create new growth corridors, especially as ASEAN countries jointly enhance their tech ecosystem.

U.S.-Indonesia Cooperation on Critical Minerals

Under the Biden administration, the U.S. government prioritized the diversification of critical mineral supply chains under the Inflation Reduction Act and the Minerals Security Partnership. In this context, Indonesia is viewed as a key partner.

While Indonesia and the United States do not have a free trade agreement, Jakarta has been lobbying for a sectoral agreement or equivalent with the United States. Negotiations have focused on harmonizing ESG standards, facilitating financing through the U.S. Export-Import Bank and U.S. International Development Finance Corporation, and enabling joint research and development on battery technologies. Additionally, in November 2023, the two countries signed a memorandum of understanding aimed at enhancing collaboration on critical mineral trade, investment, and ESG compliance.

Critical minerals are still a point of focus under the second Trump administration, demonstrated by an executive order aiming to increase domestic production and reduce reliance on China. With recent U.S. legislation phasing out EV tax credits, however, whether the administration will revive negotiations with Indonesia for a critical minerals agreement remains to be seen.

ESG and Sustainable Mining Challenges

Indonesia’s rapid industrialization of critical minerals has brought with it significant ESG concerns. Environmental damage in nickel mining zones, including deforestation, marine pollution from tailings disposal, and air emissions from coal-fired smelters, has sparked resistance from civil society and environmental watchdogs.

To address these concerns, the government has introduced stricter permitting processes, required environmental impact assessments, and encouraged green smelter development using hydropower and solar energy. Indonesia is also participating in global ESG forums and aiming to adopt OECD-aligned practices in responsible sourcing. Nonetheless, enforcement remains inconsistent, and capacity-building in regulatory institutions is needed.

Building secure and reliable rare earth supply chains is also essential to meeting net-zero goals. Unless developing economies such as Indonesia align their industrial ambitions with ESG standards, they risk their exports being excluded from high-value clean tech markets.

Regional Supply Chain Integration and ASEAN Synergies

ASEAN countries such as Vietnam, the Philippines, and Malaysia are also ramping up their critical mineral strategies, leading to both collaboration and competition. Vietnam is investing in REE refining, while the Philippines is expanding copper and nickel mining. Indonesia has advocated for a regional ASEAN framework on critical minerals to pool resources, align standards, and boost bargaining power in global markets.

Regional integration could be operationalized through ASEAN +3 or via bilateral partnerships. A regional critical minerals platform could also support shared ESG monitoring, knowledge exchange, and coordinated investment promotion.

Trade, Geopolitics, and Investment Risks

Global critical mineral markets are increasingly influenced by geopolitical considerations. Indonesia’s efforts to attract U.S. and Western investment must be balanced against its longstanding ties with China, which remains the largest investor in its mineral sector—for example, around 75% of nickel smelters in the Indonesia Morowali Industrial Park are Chinese-backed.

Trade risks also include export-price volatility, restrictive clauses in mineral contracts, and technology transfer disputes. To mitigate these risks, Indonesia needs robust investment protection agreements, arbitration mechanisms, and long-term offtake contracts. The United States, for its part, must provide policy clarity on critical mineral agreement negotiations, FTA equivalency, and ESG guidelines.

Conclusion

To enhance its role in global critical mineral supply chains while fostering sustainable development, Indonesia should consider undertaking the following:

- Finalizing a sectoral agreement with the United States that recognizes Indonesia’s ESG-compliant minerals as critical to U.S. supply security, granting preferential trade treatment and investment incentives

- Establishing a national ESG certification framework aligned with OECD standards and incorporating traceability mechanisms

- Promoting R&D and university-industry collaboration in clean processing technologies, recycling, and battery innovation

- Supporting ASEAN-wide critical mineral cooperation, including a shared platform for data exchange, standards alignment, and regional investment hubs

- Building regulatory capacity and community engagement to ensure inclusive growth and social license to operate

With coordinated reforms, strategic diplomacy, and technological partnerships, Indonesia can position itself not only as a mineral-rich supplier but as a value-added producer and sustainability leader in the energy transition.

Han Phoumin is a Senior Energy Economist at the Economic Research Institute for ASEAN and East Asia (ERIA).